Starting your professional journey is an exciting phase in life, but it also comes with financial responsibilities that can shape your future. Young professionals often face challenges like managing student loans, budgeting, saving, and investing for long-term financial security. Learning the basics of financial planning early can help you build wealth, avoid debt traps, and...

FlashNews:

Investing in Stocks: A Guide for Small Business Owners

How Background Music Can Influence Customer Behavior

The Impact of Minimum Wage Increases on Small Businesses

How to Find a Mentor as an Entrepreneur

The Best Laptops for Entrepreneurs in 2025

How Entrepreneurs Can Overcome Burnout with Healthy Habits

Creating a Financial Safety Net for Your Business

Top 5 Movies Every Entrepreneur Should Watch for Business Lessons

Understanding How National Economic Growth Affects Small Businesses

How to Navigate Uncertainty as an Entrepreneur: Tips for Resilience

How to Develop an Entrepreneurial Mindset

How Tariffs Affect Small Business Operations

Celebrity Entrepreneurs Who Are Changing the Game

The Pros and Cons of Opening a Business Line of Credit

The Benefits of Mindfulness for Entrepreneurs

How AI Is Transforming E-Commerce

Hyper-Personalized Marketing: How AI Is Revolutionizing Consumer Engagement

The Link Between Gut Health and Entrepreneurial Decision-Making

Navigating the Rise of Tokenized Assets: What Small Businesses Should Know

The Importance of Diversification in Investment Strategies

Diversification is a fundamental principle of investing, offering a practical approach to managing risk while seeking returns. In an uncertain economic landscape, diversification plays a crucial role in safeguarding portfolios from volatility and maximizing opportunities. This article explores why diversification is vital and how it can strengthen investment strategies. What Is Diversification? Diversification involves spreading...

Leveraging the Power of Predictive Analytics for Financial Planning

In today’s fast-paced financial environment, the ability to anticipate and adapt to changes plays a pivotal role in maintaining a competitive edge. Predictive analytics has emerged as a powerful tool for enhancing financial planning by utilizing historical data, statistical algorithms, and machine learning techniques. This blog post will explore the importance of predictive analytics in...

How to Use Behavioral Finance Principles in Business Decision-Making

Behavioral finance, a field that blends psychology and economics, examines how emotions, biases, and cognitive errors influence financial decisions. For business leaders, understanding these principles can lead to more effective decision-making, better financial outcomes, and a stronger connection with customers and stakeholders. Here’s how to apply behavioral finance insights in your business strategy. What Is...

How Fractional Ownership Is Changing the Way Entrepreneurs Invest

In the evolving world of finance and investment, fractional ownership is emerging as a transformative concept that is reshaping how entrepreneurs approach asset allocation and wealth creation. Gone are the days when hefty upfront capital was a prerequisite for investing in high-value assets like real estate, art, or expensive equipment. Fractional ownership democratizes access, enabling...

Setting Realistic Financial Goals for Your Startup

Launching a startup is an exciting venture, but with the thrill comes the responsibility of managing finances effectively. Setting realistic financial goals is crucial to guide your business towards sustainable growth. In this blog post, we will explore essential steps to establish achievable financial goals for your startup. Understanding the Importance of Financial Goals Before...

How to Build a Strong Financial Plan for Your New Business

Starting a new business is an exciting journey, but it also requires careful financial planning to ensure success. A strong financial plan is the foundation for sustainable growth, helping entrepreneurs allocate resources, anticipate challenges, and achieve their business goals. Here’s a step-by-step guide to building a solid financial plan for your new venture. 1. Define...

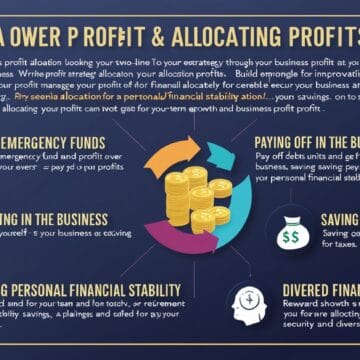

How to Allocate Your Profits for Business Growth and Personal Security

Running a successful business is not just about generating profits—it’s about managing and allocating those profits wisely. Proper allocation ensures the sustainability of your business, fuels its growth, and provides you with financial security. Striking the right balance between reinvesting in your business and securing your personal future is essential for long-term success. Here’s a...

How to Plan for Business Expansion: A Financial Guide

Expanding your business is an exciting and pivotal step in its growth journey. However, expansion also brings new challenges, especially when it comes to managing finances. To ensure your business thrives in the long term, effective financial planning is essential. This guide outlines the key steps to create a solid financial plan for business expansion....

How to Create a Financial Safety Net for Your Business

Running a business is exhilarating, rewarding—and undeniably risky. Whether you’re navigating fluctuating market trends, seasonal revenue shifts, or an unforeseen economic downturn, having a financial safety net for your business isn’t just a good idea—it’s essential. This post will not only explain what a financial safety net entails but also walk you through practical strategies,...

- 1

- 2